Are you beginning to file taxes? Then, we must come to the blunt conclusion that it is a tough journey for all of us. Calculation of tax is an essential thing that we must always perform duly because it is the primary source of revenue that our government earns so that it can spend it on us.

Earlier we had to file our taxes manually on pen and paper with the help of a financial advisor or a tax consultant to go about the process smoothly. However, with the changing age and increasing dependency on our digital ways, the procedure of filling our taxes has come alive on digital calculators. This has made our journey quite easy.

Tax Refunds

You need to pay your tax. However, often it happens that we overpay our taxes. But don’t worry because, under those circumstances, we ought to get refunds against the money that we have overpaid or to put it simply, we will get our extra money back. And these refunds are a boost for all of us.

Whether you are thinking of saving some money for your retirement, need some money to pay down your credit card debt, or require money to spend it immediately, all you need is a tax refund and it will all be sorted! Many Americans depend on their tax refund as a central part of their annual budget. So, if you are also waiting to check out on how big your tax refund will be this year, then you must know that there is an array of tax refund calculator you need to be aware of and most of them are efficient!

However, it is always great to have a good idea about the nitty-gritty of taxes and how they are charged with the help of a trustworthy financial advisor. Besides consulting with an experienced advisor will also focus on your financial goals while discussing the filing of your taxes and ensuring your financial well-being.

Weighing your Tax Refund: Here’s how you do it!

Filing your income tax with the help of these new-age tax refund calculators is a child’s play. And through this process you can learn 3 primary things:

- Whether you owe money to the IRS.

- Whether the IRS owes you money because you overpaid the last time.

- Or that you are even with your tax payment and no one holds and dues.

Now, if you discover that you owe money to the IRS, then you will have to pay the rest of the taxes or the bill that is presented before you. If the IRS owes you money, then you will get your money back in the form of tax refunds. And in case you are even, then you are good to go and can continue with any other activities that you were engaged at!

All these you can figure out faster and more efficiently than ever before with the modern tax refund calculators.

Why would you get a refund?

Have you ever wondered why would the IRS offer you a tax refund? There can be numerous scenarios when this might happen. Firstly, you might have paid your taxes more than what was estimated of you or perhaps had too much withheld from your paycheck at work. Furthermore, many times we have also found out that the person has qualified for several tax deductions and tax credits that he has almost eliminated his tax liability and is now eligible for a refund. It is essential to know that a decent calculator of taxes considers all of these scenarios and will come up with the result of whether you will be getting a refund or not. Additionally, it will also state how much you should expect as a tax refund emergency loan!

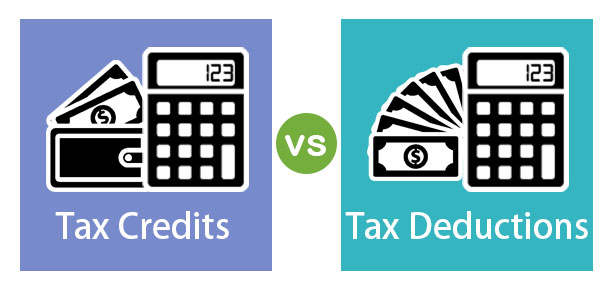

What you need to know about Tax Deductions and Tax Credits

Have you heard about tax deductions? A tax deduction means dedication that will reduce your taxable income. This will eventually cut your tax bill short. It will be done indirectly by reducing the income that’s subject to a marginal tax rate.

A tax credit is a dollar-for-dollar discount that you can have on your tax bill. So, if you owe $500 but qualify for a $200 tax credit then your tax bill will go down to $200.