All the banks in India are offering net financial offices for simplicity of reserve move utilizing RTGS or NEFT. Along these lines, a quick move of the assets can be made to the recipient’s record.

There are two sorts of offices offered by every one of the banks to move your assets quick starting with one record then onto the next record. These offices are known as Real Time Gross Settlement (RTGS) and National Electronic Funds Transfer (NEFT).

On the off chance that the sum to be moved is having an enormous worth for example 2 lakhs or more, ideally, RTGS is utilized, in which the assets are moved as and when RTGS guidance is gotten as here the exchanges are settled exclusively. It is favored for high-esteem exchanges. The timings of RTGS are from 9 a.m. to 4:30 p.m. on Weekdays and from 9 a.m. to 2 p.m. on Saturdays.

In NEFT, there is no base or most extreme breaking point on reserves that are to be moved. It is favored for lower to medium range exchanges. NEFT is an electronic reserve move framework that works on a Deferred Net Settlement (DNS) premise which settles exchanges in clusters. In DNS, the settlement happens with all exchanges got until the specific cut-off time. This is the motivation behind why, in NEFT, the assets don’t get moved promptly yet takes a couple of hours for their exchange.

Advantages of Transfer Funds Through RTGS or NEFT Online

- You can move assets from home or work environment utilizing net-banking office

- A quick move of the assets

- Access whenever, from anyplace

- No lines to remain in or hang tight for

- It is a safe and less tedious method for subsidizing the move

- You don’t need to give a check and send it to the recipient, which spares your endeavors

- You get a programmed affirmation of the handling of your exchange through SMS and email from your bank when the assets get dispatched

Focuses to Remember for Transfer of Funds Through RTGS or NEFT Online

- You have to include payee/recipient in your record to whose record you need to move the assets

- Starting and goal bank offices ought to be a piece of the RTGS/NEFT arrange

- On the off chance that you are moving the assets in any recipient’s record for the absolute first time, you should at first move a limited quantity like Rs 100 and get its receipt affirmed by the recipient and afterward make the exchange of parity sum

- Confirm the sum entered twice before making RTGS/NEFT

- You will get an affirmation of movement of assets from your bank through SMS or Email

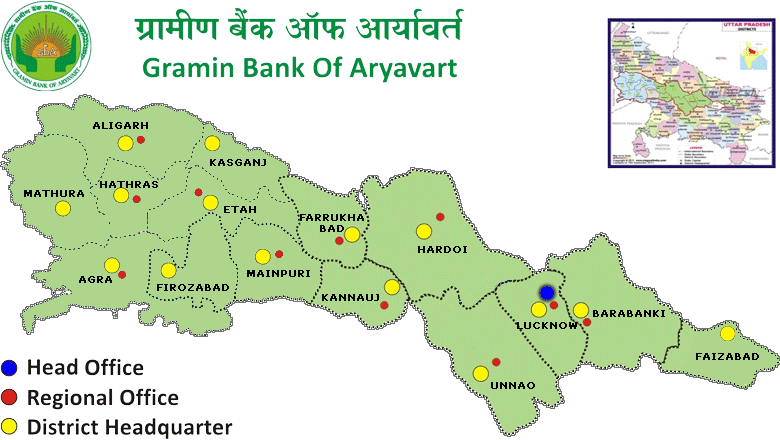

- On the off chance that Gramin Bank of Aryavart is giving the office of net-banking, at that point just you will have the option to move the assets online through RTGS/NEFT

How to Add Payee/Beneficiary in your Account with Gramin Bank Of Aryavart?

On the off chance that you need to include payee/recipient in your record with Gramin Bank Of Aryavart, you have to pursue underneath referenced bit by bit procedure to include payee/recipient:

- Visit the official site of Gramin Bank Of Aryavart

- Sign on to your record utilizing your client name (client ID) and secret key (IPIN)

- In Installments and Transfers select “Oversee Receiver”

- Presently you have to choose Inter-Bank or Intra Bank (where recipient’s record is additionally in Gramin Bank Of Aryavart) choice, Payee

- Pick “Include Payee” alternative

- Fill in Payee/Beneficiary’s subtleties, for example, Name, Account Number, Bank Name and IFSC Code in the significant segments (suppose you transfer money to Indian bank avinashilingam branch so here Indian bank avinashilingam branch ifsc code is IDIB000A005 and aryavart bank ifsc code is BKID0ARYAGB)

- Tick the “I Accept Terms and Conditions” checkbox given at the base of the page

- Snap-on “Affirm” or “Proceed” button

- A One Time Password (OTP) will be sent on your enlisted versatile number as the second layer of security

- Enter the OTP to verify the enrollment of the recipient

- At that point, the recipient will be included

- The additional recipient will be enacted in no time flat/hours

- After the enactment of the recipient, you can move assets to the recipient’s record

Some very useful Website where you can find bank details easily like bank ifsc code, bnak micr code, bank address, bank all branches

How to Transfer Money Through RTGS or NEFT Online from Gramin Bank Of Aryavart?

So as to Transfer Money Through RTGS or NEFT in Gramin Bank Of Aryavart Online, you have to pursue underneath referenced bit by bit procedure to Transfer Money Through RTGS or NEFT Online:

- Visit the official site of Gramin Bank Of Aryavart

- Sign on to your record utilizing your client name (client ID) and secret key (IPIN)

- select “Reserve Transfer” choice

- The new page will rattle off various alternatives for reserves to move. Select Inter Bank (Transfer to other banks) or Intra Bank (Transfer Within the Bank) Payee through RTGS/NEFT

- Select the Transaction Type: RTGS or NEFT

- Pick the recipient from the rundown of recipients existing in your record, to whom you need to move the assets

- Enter the Amount to be moved

- Compose Transfer Description. Attempt to give important “Move Description” which will assist you with keeping a decent track of your exchange

- Tick the “I Accept Terms and Conditions” checkbox given at the base of the page

- Snap-on “Affirm” or “Proceed” button

- At that point, the RTGS/NEFT Fund Transfer will be started. It’s prescribed to print this page or take its screen capture for your future reference.