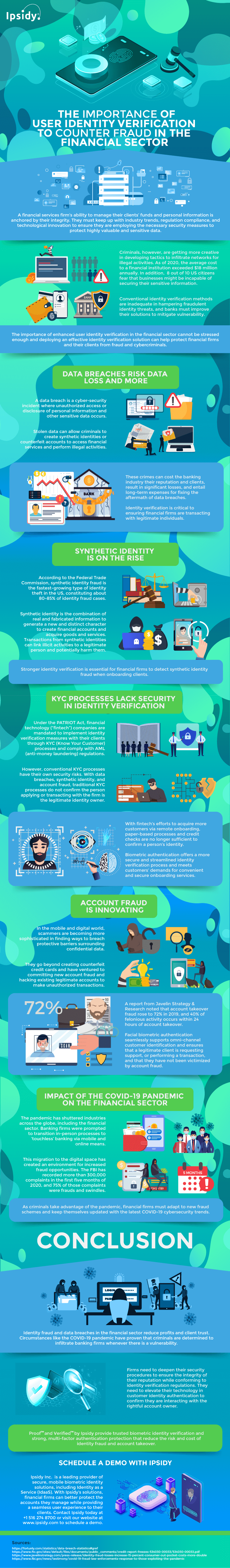

Financial services firms must keep up with industry trends, comply with regulations, and use new technologies to ensure that they are competitive in the industry. Following regulatory requirements and using innovative technologies allows a firm to securely manage their clients’ funds and personal information as the criminals exploit outdated security measures and infiltrate otherwise secure networks.

The outdated conventional identity verification methods that some firms use cannot hamper fraudulent identity threats as criminals develop tactics to breach old systems. Right now, 8 out of 10 US citizens are afraid that businesses can’t secure their sensitive information. Firms must invest in new solutions to mitigate risks.

Having an enhanced user identity verification solution in place is vital in the financial sector to protect both the firms and their clients from fraud and scams. Without a reliable user identity verification platform, financial institutions will likely suffer from data breaches, synthetic identity fraud, and account fraud, among other cybercrimes.

Financial technology companies are mandated to implement identity verification measures under the PATRIOT act. The verification measures are required for KYC or Know Your Customer processes and for compliance with AML or Anti-Money Laundering regulations.

Conventional KYC processes are at risk from data breaches and frauds since such methods can’t confirm the identity of a person applying or transacting with the company. Remote onboarding, paper-based processes, and others are no longer enough to confirm a person’s identity. Biometric authentication, on the other hand, offers a secure and streamlined identity verification process that meets their customers’ preferences for convenient onboarding services.

Financial firms must invest in biometric identification solutions like facial biometric authentication as they are more secure and reliable solutions to identify a customer’s identity. Facial biometrics seamlessly support omnichannel customer identification and ensure that the person requesting support is a legitimate client and not one with a false identity.

Thanks to the global coronavirus pandemic, multiple firms had to adapt and use mobile and online solutions for banking purposes. The new business landscape opened up cybersecurity risks, and firms must invest in new solutions to mitigate new threats. For more information, see this infographic by Ipsidy.