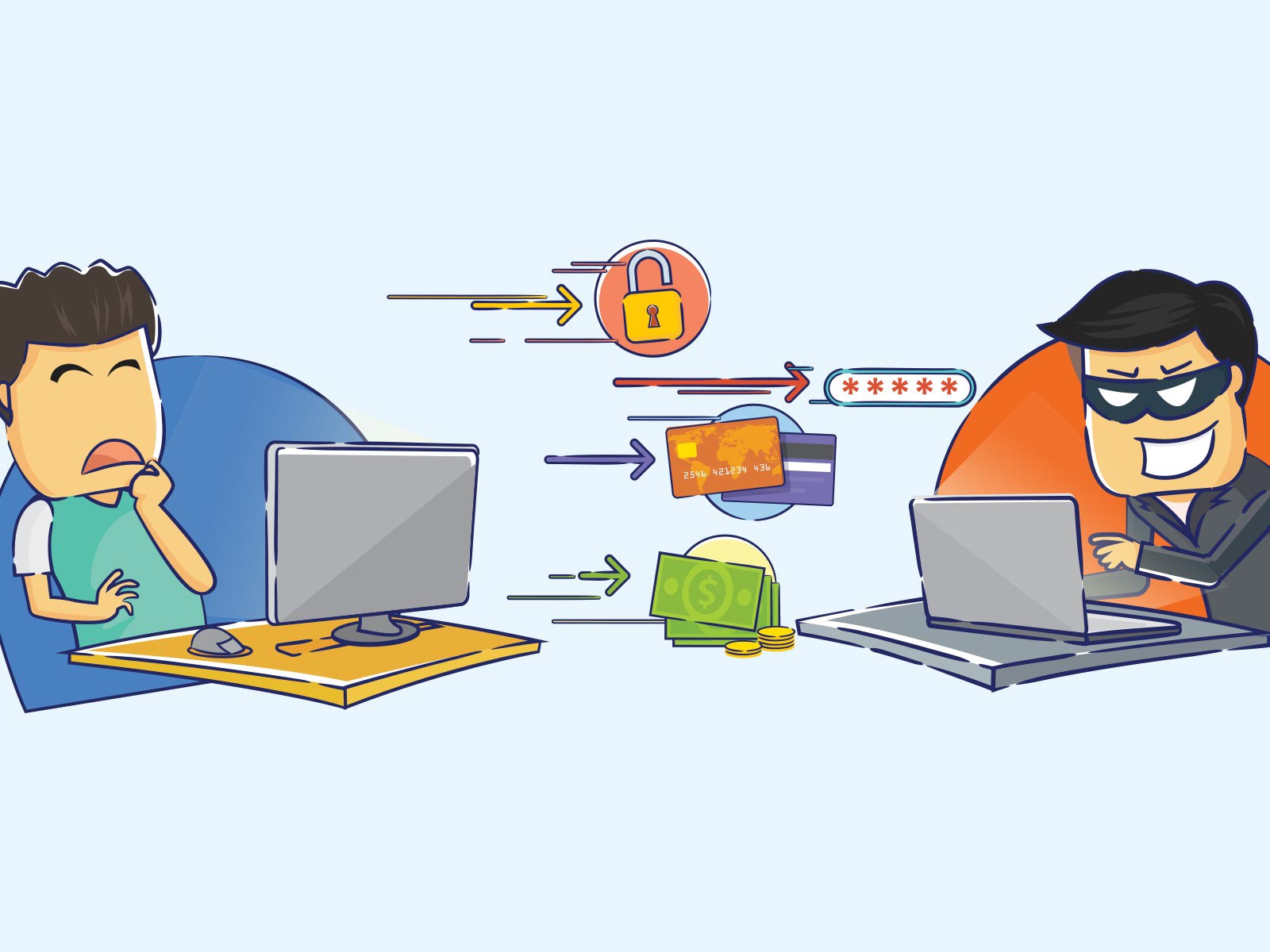

While credit cards make life easier as you do not have to carry wads of cash in your wallet to shop, there are some risks associated with it too. One of the issues credit cardholders face is credit card fraud. Though there is a lot of awareness about credit card fraud, there are many ways scammers still continue to steal your credit card information. If you have a credit card and want to know how to use it safely, read on.

What is credit card fraud?

Credit card fraud is a comprehensive term that covers any theft or fraud that is committed using your credit card without your authorisation. It is a form of identity theft. Credit card fraud can take place if you have lost your card or if your data has been compromised. To make a legitimate transaction, you will need your physical card or important information like your credit card number, expiry date, and the Card verification value (CVV).

Fraudsters come up with various ways to crack the security features of the card and get the credit card information they need to make illegal purchases. If you lose your card or feel the data is being misused, you will have to alert your credit card provider immediately.

How to prevent credit card fraud

1. Keep your credit card safe:

If you have multiple credit cards, it is recommended to carry only one card that you are going to use that day. Keep your credit cards safe at home if it is not required. If you lose your wallet, you do not have to go through the hassle of blocking all the credit cards you have. Fraudsters aren’t only online. Anyone can steal your credit card and misuse it before you realise it.

2. Prefer Chip-and-PIN credit cards:

Credit cards with magnetic strips are quite common in India. If you have a magstripe credit card, consider getting a Chip-and-PIN card. Unlike credit cards with magnetic strips, Chip-and-PIN cards offer an additional security layer as it requires you to enter your PIN to transact. From early 2016, many credit card providers in India started issuing chip-enabled cards. The Reserve Bank of India intends to wipe out all magnetic strip credit cards soon.

3. Dispose your credit card statements wisely:

Your monthly credit card statements have a lot of information about your card such as the card number, your registered mobile number, your address, and name. Fraudsters can steal your credit card information from your statements. If you receive your monthly credit card statements via post, make sure you shred the statement or keep it at a safe place. If you receive your e-statements, make sure it is not saved on your phone or laptops.

4. Think twice before you make a payment online:

Phishing is one of the ways fraudsters use to steal your credit card information. What is Phishing? Phishing is a fraudulent way to steal sensitive information like usernames, passwords, and credit card information by disguising as a reliable entity through electronic communication. If you receive an email from a trustworthy entity asking you to click on a link and update your credit card information, do not fall for it. The entity can use a well-established entity’s name and may have a website that looks legit but it is a scam. Do not click on any links you receive via email and enter your card details. Your bank or credit card provider will not ask you to do so. If you are confused if you should respond to an email, get in touch with your credit card provider and confirm it with them.

5. Report any suspicious activity:

If you notice anything suspicious, report it to your credit card provider immediately. If you lose your card or think that your credit card data is compromised, block your card right away. All credit card providers in India have a hotline number to a report loss of credit card.

Other ways you can avoid credit card fraud

- If you use your credit card to shop online and have saved your card to make quick purchases, make sure you set strong passwords for your shopping accounts. Use a combination of upper and lower case alphabets, symbols, and numbers.

- Sign on the back of the credit card as soon as you receive it. This way, even when you lose your credit card, they won’t be able to forge your signature.

- Consider carrying your cash and credit card separately. Most of us carry both in our wallet and when we lose the wallet, we lose the card too.

- Do not share your credit card information or give your card to anyone.

- Do not share your credit card information over the phone unless you placed the call and you are sure the other party is reliable.

Educate yourself about various ways fraudsters use to get your credit card information and stay alert all the time.