After weeks of searching, you have finally found the next Microsoft and Apple that will give you rocket returns. Sales growth rates are explosive, margins are above industry and returns are astronomical. Above all, management is honest and capable.

Wait – before you get excited and rush to call your broker – let me tell you the rule in investment returns: The price you paid determines your rate of return.

So, the secret of finding explosive returns is finding great companies at good prices?

Well, this is the main thing that is usually missed.

How do we know that our great company is trading at good price?

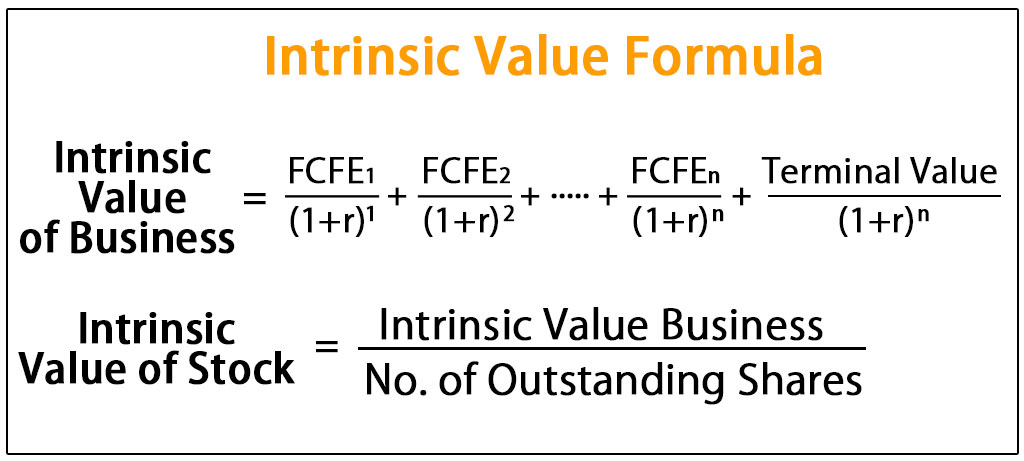

The answer is we calculate the intrinsic value of the great business.

Defining Intrinsic Value

Intrinsic value represents how much the company is really worth in terms of the value of its assets and/or or the cash flows that its assets is generating.

In simpler terms, intrinsic value is the business value – in contrast to current market price.

So, why do we need to calculate the intrinsic value of the business?

Here are three reasons why:

1. You need to determine the price of the stock

Let’s say you wake up one day that your favorite stock went up by 10% on strong earnings. From a price of $10 a share yesterday, it is now trading at $11 a share.

Then you look at the price, you say – based on the business value – it’s still cheap. So, it’s a buy.

Conversely, if you calculate the intrinsic value and you found out that the stock is worth $8 a share. At $11 a share, it’s expensive. So, it’s not a buy or if you’re holding shares, you probably would sell.

2. To know your expected returns

The purpose of investing is all about generating returns. In every investment decisions, you should know how much is your prospective returns. You can easily calculate your returns with the help of zerodha margin calculator from the purchase of the stock, once you have an intrinsic value.

Let’s go back to the previous example:

If you calculate that the intrinsic value is at least $25 a share and the stock price is at $11 a share, your return from purchasing the stock is 127. The stock is a screaming buy!

3. To know your opportunity costs

We live in a world where investment choices are plenty. You need to know whether or not you will be investing in some real stocks or not? In stock marketing investing, there are many stocks that we can choose in different industries.

How do we construct a portfolio?

We should pick stocks that offer higher returns for a reasonable amount of risk. Let’s say your target return is at least 15% annually, you should choose investments that offer you returns above that rate.

If stock Alpha offers 50% based on calculation of intrinsic value while Stock Beta offers only 10%, you choose Alpha over Beta.

Through this, your investment decisions will be optimal and based on expected returns.