ELSS mutual funds are the most popular mutual fund category in India which not only helps in wealth creation, they also save taxes. In fact, ELSS funds are the only mutual fund scheme which allows tax benefits on the amount that you invest. You can claim a deduction of up to INR 1.5 lakhs by investing in an ELSS fund in India. This deduction, available under Section 80C of the Income Tax Act, 1961, helps you reduce your tax liability while at the same time creating an investment. Given this nature, ELSS funds are also called tax saving mutual fund schemes.

Besides the tax-saving benefit, other advantages of tax-saving fund ELSS include the following –

- Attractive returns through equity-linked investments

- Easy liquidity after a lock-in period of 3 years

- Tax-free returns up to INR 1 lakh

- Ease of investment through lump sum or SIPs

So, if you want to invest in attractive returns and also save taxes, ELSS can be the ideal choice. But do you know which ELSS fund to choose from?

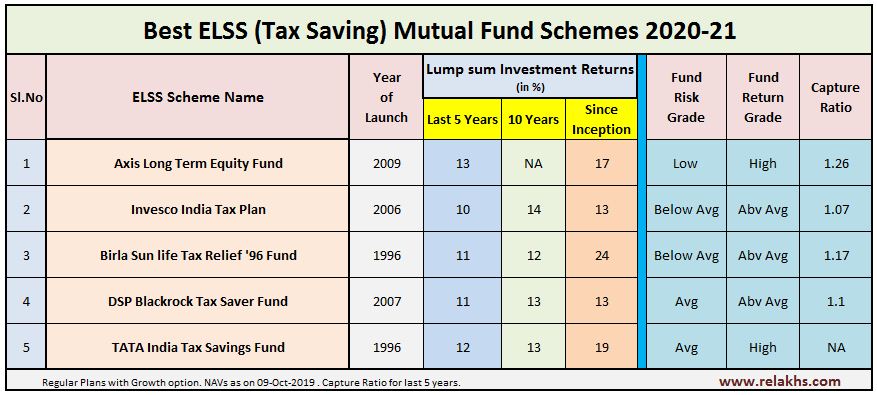

Given the advantages of the tax-saving funds, ELSS schemes are offered by all mutual fund companies. As such, you have many options when choosing an ELSS scheme. To choose the best ELSS fund in India, you should compare the available schemes on their returns. The best schemes would be the ones that have given the highest returns at a consistent rate among their peers. To make your work easier, here are the top five ELSS fund in India which have given the highest returns on investments –

| Name of the scheme | Launch date | AUM as on 31st March 2020 (in crores) | 1-year return* | 3-year return* | 5-year return* |

| Axis Long Term Equity Fund | January 2013 | INR 137,208 | -6.4% | 6.25% | 6.93% |

| Mirae Asset Tax Saver Fund | November 2015 | INR 43,200 | -12% | 4.89% | NA |

| TATA India Tax Saving Fund | October 2014 | INR 51,103 | -15.19% | 0.68% | 6.48% |

| Canara Robeco Equity Tax Saver Fund | January 2013 | INR 17,942 | -7.87% | 5.14% | 5.91% |

| Invesco India Tax Plan | January 2013 | INR 25,683 | -11.96% | 3.43% | 6.4% |

Disclaimer – *The returns are recorded as on 21st April 2020

(Source: https://www.etmoney.com/mutual-funds/equity/elss/38)

These are the best ELSS fund in India which you can choose to invest in especially currently when the market is bearish in nature. You can buy at a reduced NAV and then reap the profits once the pandemic is over and the financial markets stabilize and correct themselves.

Before investing in ELSS funds, however, the following points should be kept in mind –

- Every investment that you do, whether lump sum or SIP, would have a lock-in period of 3 years during which the fund cannot be redeemed or switched

- Returns earned from ELSS funds would be allowed as a tax-free income provided they are up to INR 1 lakh. If the returns exceed INR 1 lakh, you would have to pay a tax on the excess returns. The tax rate is 10% and it is applied to the returns exceeding INR 1 lakh. For example, if you earn a return of INR 1.2 lakhs from your ELSS investment, you would have to pay a 10% tax on INR 20,000 which would result in a tax liability of INR 2000

- Choose a direct scheme of ELSS funds. Direct schemes are better than regular schemes as they have a low expense ratio. A low expense ratio means higher returns on your investments

- Always compare and invest in an ELSS fund in India. The comparison would help you choose the best ELSS scheme which gives the highest returns.

ELSS mutual funds are an ideal investment tool for long-term savings and tax planning if you don’t mind taking the equity risk associated with the scheme. You can invest over a long term horizon and get attractive returns from ELSS mutual funds. Moreover, if you choose from the top-performing funds listed above, your returns would also be the highest allowing you to maximize your wealth to its fullest potential.