Did you know there are over 1.95 billion websites in the world? The number of online shopping websites around the globe have more than doubled in the last 2 years. Customers are shopping on the internet more than ever before.

If you are planning on starting your online business, one of the main things to decide is how to collect payments on your website.

Reasons you need online payments in 2019:

If Internet adoption and online shopper trends aren’t convincing enough, here are 4 superb reasons why you need online payments for your business in 2019 –

1. Easy to Set up:

Most payment gateways or payment providers allow you to set up online payments on your website easily. There are several integrations available that you can plug in on your website and get started in under two minutes.

2. Affordable for your online business:

Online payments are the easiest and most affordable when it comes to collecting money. Imagine having to deal with money orders or cash every time you make a sale online! Most providers charge a small fee – either on a transaction basis or on an annual basis.

3. Get Customers from all around the world:

The internet opens up the world to you. If you accept online payments, anybody can buy from you sitting in any corner of the world! This means a huge potential for your business to grow not just locally, but also internationally.

4. Provide great customer service:

As most online shoppers prefer paying online, giving them a smooth shopping experience on your website becomes an added bonus. Online payments allows the customer to automate the entire shopping experience in just a few clicks.

5. Because your competitors are offering it:

Sure, you want to be different in the market where it’s saturated with players. But you don’t want to be missing out on sales because you are not innovating. Every other tom, dick, and harry is offering the option of online payments to their clients, then why not you?

In this article, we will discover the easiest and the best and safe ways businesses use to collect payment online.

1.Credit Cards and Debit Cards:

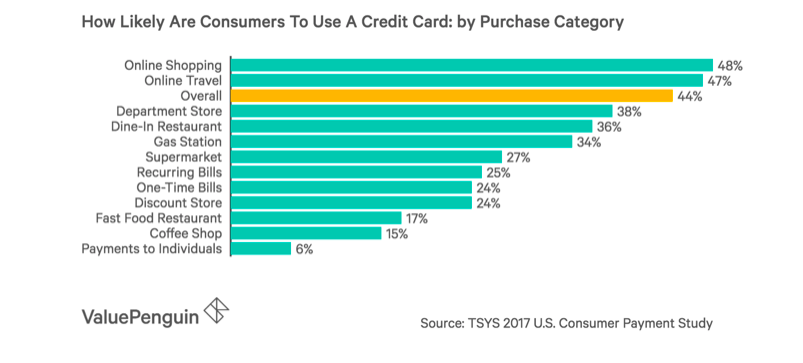

Allow your customers to pay your with Debit and Credit Cards. Two in three online shoppers prefer to pay with cards. MasterCard, Visa, and American Express are the most commonly accepted cards around the world.

Image source: ValuePenguin

To be able to accept Credit and Debit cards, you need to have a merchant account with a bank or integrate with a payment gateway. Other payment providers like PayPal and Instamojo allow you to accept payments online without too much paperwork. Just sign up, give your business and bank account details and you are ready to collect payments from your customers online.

Instamojo is the best payment gateway in India. It allows you to get started in under 2 minutes. There is no set-up fee, and no additional costs to your business. Just sign up with your email ID and phone number, give your bank account details and you are set. It also gives you a free online store so if you are looking to make a website, Instamojo online store gives you one for free which comes in-built with payments. Instamojo also allows you collect payment with payment links that can be shared with customers on SMS, Whatsapp, email, social media – facebook, twitter etc, and more. You can collect EMIs, payment for event tickets, tours and travel payments, consulting fees, freelance work payments, partial payments and more.

2. Direct Bank Transfers:

Many businesses still stick to using direct bank transfers as a mode of online payment. How this typically works is – you send your customer you bank details and they wire you the money that directly reaches you bank account.

You can either send your customer the bank details over email or phone number, or display your account details on your website.

Myth: Displaying my bank account number makes it vulnerable to frauds and hacks.

Truth: Banks all around the world offer layers of security to your account. As long as you are not revealing personal details like your CVV, or Secret Code numbers, your account is safe.

The problem with most bank transfer modes is that it can become difficult to reconcile when balancing your books of accounts. With Instamojo bank transfer method, you can create a special, unique 20-digit account number that can help you easily balance your books.

3.Mobile Wallets:

e-Wallets have grown rapidly over the years. Today it is a billion dollar industry with over 2.07 billion people using mobile wallets to make payments. Wallets like mobiKwik, Paytm, Alipay, WeChat, and even Whatsapp payments are a great and safe way to collect payments from customers online.

Mobile wallets allow your customer to make a payment to your phone number connected to your mobile wallet/bank account. You can then transfer the money from your mobile wallet into your bank account.

Instamojo allows you to collect payments with over 100 modes of payments – bank transfer, all credit and debit cards, wallets like Google Pay, MobiKwik, OlaMoney, Paytm UPI and more.

BONUS: Ways to protect your online payments as a business

Always use safe payment gateways, look for authentic certifications like PCI-DSS etc.

Encourage your customers to practice safe online payment practices – (never share secret codes, CVVs etc)

Always collect receipts for every transaction. Having proof of transactions can protect your from chargebacks and online frauds.

Take precautions while building your website – have firewalls in place and place secure redirects.

Write Bio:

Rapti Gupta, Content Marketing Head @instamojo.com. Content Marketer, Payments Enthusiast, Short Story Writer, and storyteller.